Pay Your 4868 Estimated Tax Help

- Login to Pay.Guam.gov. If you do not have a PayGuam user account,

you must register for one to make a payment online.

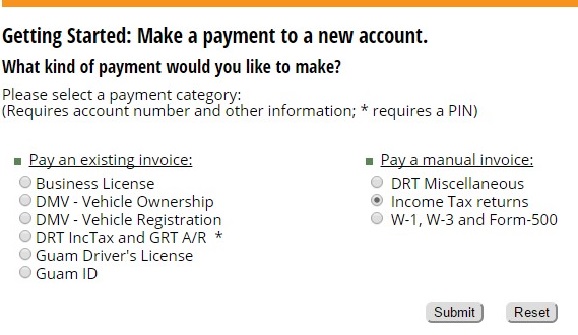

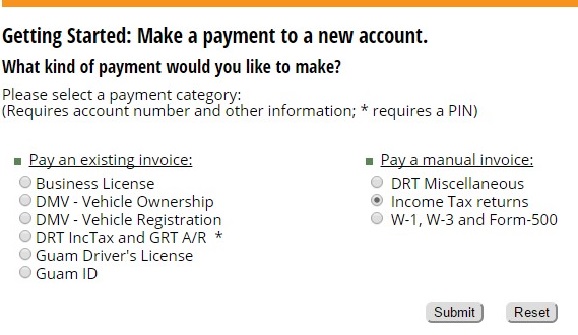

- Choose your payment type by selecting the radio button next to

"Income Tax returns" toward the bottom of the page,

as shown below:

- Click Submit.

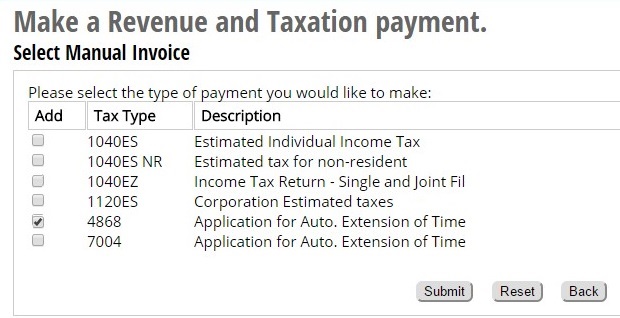

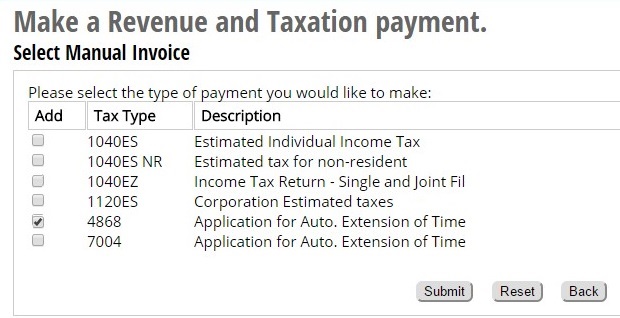

- Next, click on the box next to 4868 - Application for Auto. Extension of Time

as shown below:

- Click Submit.

- Enter the required invoice information. NOTE: To complete the required

fields, you will need a copy of your e-filing confirmation page.

- Click Add Invoice.

- Review the details of your transaction, then click Proceed to

Checkout.

- Verify your transaction total and note the added convenience fee. Click Confirm Payment.

- Enter the payment information requested. Click Pay Now.

- Print a copy of the Confirmation Receipt for your records.

FAQs

Online Individual Services

Online Business Services

Online Payments